For small businesses and entrepreneurs starting on their journeys, the idea of accepting credit card or debit card payments may seem like something they will eventually add in the future. These small business owners may believe that customers will forgive them for being a little behind the times at first. However, that type of thinking is dangerous for a small business trying to get its footing. While accepting card payments may still technically be optional, today’s consumers don’t seem to agree.

The convenience and security of credit and debit card transactions today make them impossible for even the smallest businesses to ignore. Now that customers can complete a transaction with a simple dip or swipe of a card, most people don’t even bother to carry cash with them, or only do so under special circumstances. Businesses that don’t accept card payments run the risk of alienating a large segment of their customer base. Ultimately, they could push customers toward a competitor that does accept cards. The takeaway for small businesses or entrepreneurs? Accepting credit and debit cards needs to be a priority and, thus, implemented as soon as possible.

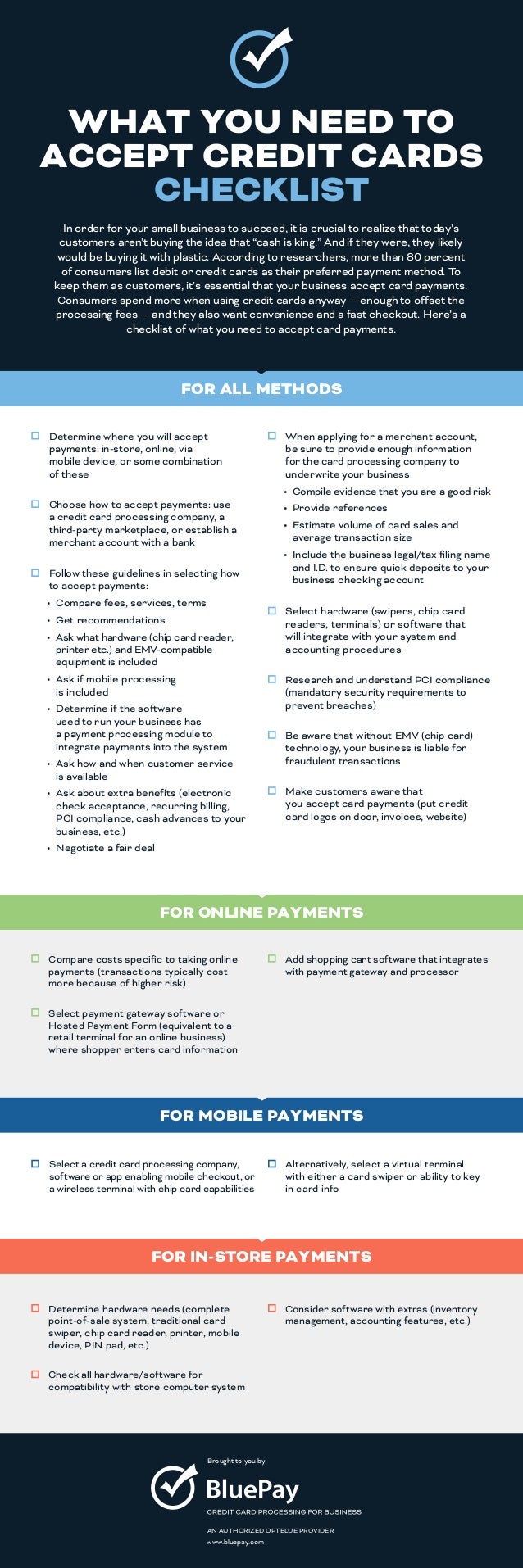

However, knowing where to begin can be an overwhelming task for many small businesses. Accepting credit and debit card transactions not only requires the technology, but it also necessitates knowledge about the regulatory requirements and the responsibilities of the merchant. First of all, merchants must decide how they’ll accept payments — whether they’ll use a credit card processing company, tap into a third-party marketplace, or establish a merchant account with a bank. It’s also essential that merchants choose a hardware and software platform for their point-of-sale systems that integrates with their existing accounting software. In addition to those brick-and-mortar concerns, some merchants may need to ensure that their card payment solutions extend to online transactions.

Accepting credit and debit card payments is an indispensable element of a business’s success in the here and now. Rather than allow the complex nature of accepting card payments discourage you from it, read the following checklist. It gives you a point-by-point breakdown of all the crucial decisions you’ll need to make to take the plunge. There’s nothing optional about accepting card payments anymore, so make sure you’re not left behind.

What You Need To Accept Credit Cards Checklist created by BluePay

Author bio: Kristen Gramigna is Chief Marketing Officer for BluePay, provider of fast, easy and secure payment processing solutions. She brings more than 20 years of experience in the bankcard industry in direct sales, sales management and marketing.